Interview by Valeria Camia, journalist, web director Corriere dell'Italianità, to Manuela Andaloro Senior Advisor and Board Member, for Corriere degli Italiani

A successful entrepreneur, an ambassador of gender equality, and a mother, Manuela Andaloro tells her story.

Business woman Manuela Andaloro has been the CEO of SmartBizHub since 2017. Together with her team, she does management consulting, especially in the field of new technologies and sustainability, working with multinationals and government agencies throughout Europe. Manuela travels often and is active in advocating and raising awareness on diversity, gender equality and on the balance between family and work. She was recently nominated for a major award on gender diversity. For many years, she has been advocating “diversity and inclusion” in companies. Could Manuela picture her current reality when, just a twenty-year-old student at IULM University in Milan, she got her first corporate role as an analyst at ACNielsen, working hard to keep up with her studies?

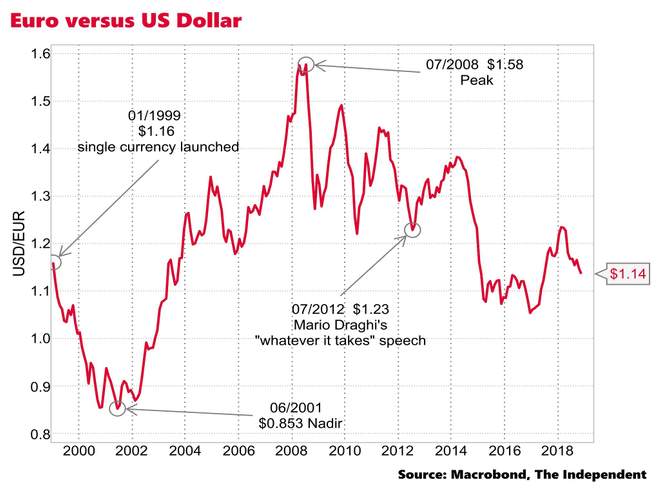

Manuela has been not only a successful entrepreneur in recent years, for over 17 years she has had important roles in leading financial companies in Europe, since 2012, she’s also a mother. A mother of two small children (4 and 6 years old), in Switzerland, a country in which achieving a balance between family and work is particularly complicated. Maternity leave is granted for only 3 months and fathers are excluded, as opposed to a European average of 6 to 12 months (or even 3 years in Germany) of leave, which in many cases can be shared equally between both parents. If wage parity remains a dream, the same goes for career opportunities, respect for diversity and promotion of social inclusion.

“Finding a balance between career and family is one of the hardest challenges that my husband and I – along with hundreds of parents with careers, I have met over the years – are facing in Swiss society, which in most cases still gives women the role of housekeepers and child carers. This concept is deeply rooted in the culture of this country. I still remember this chat I had with a doctor I had consulted because I felt tired after the birth of my first child and my return to work 5 months later. I remember the doctor asking me why I kept on working. It was shocking. And that was just the beginning. I was shocked again when I went back to work, first part time, then full time. Society in many cases expected me to be mainly a mother”, says Manuela, who considers herself lucky, because “there was still a job for me when my maternity leave was over if you consider that one in seven women in Switzerland loses her job when she becomes a mother.” Not to mention the economic situation, as private nurseries and kindergartens, that can provide more flexible times to allow parents to work, are very expensive and so precluded to many.

To be honest, Manuela actually had some thoughts about giving up her career, or taking a break. It was never easy to leave my children with the babysitter or at the nursery until late, to work and travel even on weekends, and being under the critical eye of society. But Manuela did not give up. She was courageous and aware of the need to break up with an obsolete, individualistic and non-empathic mindset, which does not leave enough space for women and is unable to cope with the new global picture of society and its stakeholders.

— Images, left to right: Manuela Andaloro moderating a FinTech international event in January 2019 in Zurich (credits: British Embassy Bern); speaking about adapting our working cultures to reflect a more modern world and diverse society, June 2019, Amsterdam. (Credits: EWPN, Money 2020); on stage speaking about new role models and leadership, October 2018, London (Credits: PayExpo); Balancing private life and work on a weekend. —

The trump card that can reconcile career and family, says Manuela, is a new type of EQ-driven leadership. “The best leaders of today invest their time and energy in understanding the people they work with and their teams. It’s the EIQ, or emotional intelligence quotient, which experts say has become today more important than IQ and is a better index of success for people, companies and society. This is why we must work to change the old mindset: a new approach will not only favour women but will also foster a type of leadership based on empathic soft skills. In the digital age and its new challenges, women should not be fighting to integrate themselves into a system that has proved to be disastrous as it supports only one model, the alpha personality, mostly very dominant figures. I met women that had old-fashioned leadership styles, not very cooperative and participatory, and men who lead in an inclusive way and pay attention to the social fabric outside and inside the company. Adopting a leadership based on arrogance, blind self-confidence and lack of empathy does not work today, in the face of the probable failure of liberal democracies, the negative influence of social platforms, the climate crisis, artificial intelligence and the associated risks. Both women and men should all work together to transform the mindset of companies (and politics), making room for the new facts on the ground”.

For women, it means they have to learn to believe more in themselves, to not settle for less and to act, without always waiting for the right moment in decisions concerning private and working life – to have a child or to accept a new role of great responsibility that involves changes. “Sacrificing one’s ambitions even before trying is harmful to oneself, to other women, to new generations and to the men that are witnessing this behaviour”.

On 14 June, over half a million women and men across Switzerland joined the demonstrations following the strike, plus all those who participated in a “digital” way. What do you wish for, Manuela? “I wish for strong governmental reforms and independent inspections of companies to assess corporate culture, and diversity within them. And I also expect each of us to raise awareness of issues of vital importance, in each of our daily roles, as mothers, fathers, teachers, workers, leaders. Starting from making our children aware of the importance of equality, inclusion and an open mind-set to face today’s new challenges”.

Manuela Andaloro is a senior professional with over 19 years of executive experience in global roles in financial services, business strategy and digital transformation, having lived in Milan, London and Zurich and worked for firms such as Nielsen, Financial News and UBS. Since 2017, she is the Founder of Swiss-based SmartBizHub, a management consultancy specialising in marketing, positioning, communications, sustainability, future tech and future work. Manuela is a professional speaker, a published author, and an editorial consultant for various leading publications on the topics of finance, social shifts, impact, culture and leadership. She serves as advisory board member of various Swiss and international organizations, and as a board member of the Weizmann Institute of Science in Europe. Manuela is a D&I champion and advocate for EQ- driven leadership, speaks English, Italian, German and Spanish and lives in Zurich with her husband and two children.

As published in Corriere dell’ Italianita’ cover story, 30 July 2019 view original article in Italian here.